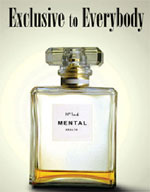

Marketers have long known that people are drawn to exclusivity. Some people pay small fortunes to attend exclusive, private colleges while others wait in line for hours for the opportunity to buy exorbitantly priced drinks in an exclusive nightclub.

Marketers have long known that people are drawn to exclusivity. Some people pay small fortunes to attend exclusive, private colleges while others wait in line for hours for the opportunity to buy exorbitantly priced drinks in an exclusive nightclub.

As noted in Kiss Of Death, exclusivity can kill a small company. Unfortunately, many Big Dumb Companies (BDCs) believe that the only way they can effectively compete is to skew the market in their favor by precluding you from freely working with anyone you choose. Exclusivity excludes the BDC from competing in the free market while excluding the startup from taking full advantage of future customer, partner and market opportunities. Such deals are not exclusive, they are excludesive.

The only exclusivity you want associated with your startup is the kind described in Peace & War Corps – your employees should feel that being part of your adVenture is a privileged opportunity.

In most instances, you will be successful in establishing meaningful relationships with BDCs without agreeing to excludesive provisions. However, even the most skillful negotiator will occasionally be forced to agree to some level of excludesivity. Under such circumstances, you can minimize the degree to which such exclusions limit your adVenture’s future flexibility by applying one or more of the following suggestions.

Not in my Job Description

One way to avoid excludesivity is to simply state, “It is against our company policy to grant exclusivity…” or “my Board simply will not allow it.” True ATM Operators will relate to such arbitrary rules and respect that there are some things “you just cannot do.”

De Facto Competitor Avoidance

Excludesivity is usually an important issue when you are trying to strike an initial relationship within a particular market or product segment. Once you establish a non-exclusive partnership, you can reference it when other BDCs ask for excludesivity. An initial, non-excludesive deal will effectively take the issue off the table.

In fact, once you publicly announce your new partnership (and you will be free to do so because you applied the negotiation principles described in Kiss of Death), your initial partner’s competitors will be motivated to work with you. The extent to which rival BDCs will seek you out, in the hopes of striking a similar deal, will be predicated on the impact your initial BDC partnership has on the market. If you are excluded from establishing such additional BDC relationships, you will encourage direct competition, as the rebuffed BDCs will proactively establish similar partnerships with someone (often with anyone) as a means of countering what they view as a competitive threat. Thus, in order to avoid creating competitors, craft your first BDC deal without excluding other potential partners.

In a few instances, I was able to drive a non-excludesive deal to closure by making it clear to my future BDC partner that being the first to enter into a relationship with my company would grant them “de facto” exclusivity. Most startups cannot effectively implement multiple BDC partnerships in parallel. As such, make it clear to your potential partners that the first BDC to ink a deal will have your company’s sole focus through the development and implementation of the partnership. This will ensure the initial BDC a de facto lead on their competitors. It may also provide the BDC with an opportunity to influence your technological development and conform it more closely matches its technology roadmap.

Irrespective of any potential technological advantages, being the first partner guarantees the initial BDC a degree of exclusivity, as there will be a period of time in which their offering will be the only one in the market paired with your technology. Clearly, the duration of this de facto status is dependent on a variety of factors, but in some instances, simply being first might be a satisfactory alternative to formal excludesivity.

Trick Ear

I seldom acquiesced when it came to excludesivity. If my Bro Foe proposed excludesivity, I would joke and say, “I am sorry, that is my trick ear. It does not hear the ‘e’ word.” I would then make it clear, all joking aside, that excludesivity was simply not acceptable.

Even so, there a few instances in which my Bro Foe had an edict from his BDC brethren that he or she “had” to get exclusivity. In these rare instances, we negotiated deals in which my Bros could claim they had obtained “exclusivity” and my adVenture’s flexibility was not unduly compromised.

After I made it clear that excludesivity was not something we were prepared to do, I would suggest that we table the issue and negotiate the remainder of the deal points. In this way, I put my Bro Foe on alert early in our discussions that the overall deal must be highly advantageous in order for my company to accept any form of excludesivity.

Fortunately, when the other party insists on excludesivity, there are various antidotes that entrepreneurs can deploy to mitigate the negative impact of an excludesive relationship, including:

- Minimum Commitments – Force the BDC to cover your opportunity costs

- Limited Scope – Conscribe the exclusions as narrowly as possible

- The Short List – Clearly define the universe of who and what is excluded

Minimum Commitments

There are real and often significant opportunity costs associated with excludesivity. If you agree to unfettered excludesivity, you are essentially precluding your adVenture from working with every other company on the planet. The cost of such a decision is tremendous and you must be compensated for it.

In addition to the opportunity costs associated with unfettered excludesivity, there exists an additional and potentially more hazardous risk. Once the BDC realizes that none of their competitors can establish a partnership with your firm, it is under no pressure to devote the resources necessary to make your partnership successful.

If the BDC has no competitive incentive to market your solution, there is a real risk that it will put your technology “on the shelf” and move on to the next entrepreneur whose technology must be kept out of reach of the BDC’s competitors.

The best way to ensure that the BDC will remain focused on promoting your technology is to require it to commit to a minimum amount of revenue in order to retain excludesivity. However, do not attempt to structure the minimum commitments as financial obligations that must be paid to your firm irrespective of the BDC’s actual sales. Even if you are successful in negotiating such a potentially contentious arrangement, the likelihood that your adVenture will be paid if the deal is a dud is very low. Instead, use the sales commitments as a minimum threshold by which excludesivity remains in place. If the BDC fails to attain a particular threshold, your relationship continues, but in a non-excludesive fashion. This will incentivize the BDC to promote your solution, to the extent maintaining excludesivity is important to them.

As noted above, you should ideally negotiate all the other significant deal points before tackling excludesivity. Your Bro Foe may find that excludesivity is not as important as they had thought at the outset, due to the particular structure of the deal, the markets being pursued, etc.

Another advantage to waiting is that you can encourage the BDC to hype the ultimate size of their minimum commitment by asking, “If we were to agree to an excludesive arrangement, how many units do you think your company could sell in the first year?” In this context, your Bro Foe is inclined to communicate a very large number. Write this number down. It will come in handy if you later are forced to establish minimum commitments. Using your Bro Foe’s words against them is a powerful and effective negotiating technique. They key is to get them to commit to a large minimum figure outside the explicit discussion of minimum commitments.

Limited Scope

Excludesivity comes in a variety of flavors. You can constrain the degree to which a relationship is excludesive by including one or more of the following factors in the definition of excludesivity:

- Time – ideally less than one year. Be sure that you are not precluded from speaking with competitors during this time period. For instance, if your agreement calls for a year of excludesivity, you should be able to negotiate agreements with competitors during that year, with the understanding that you cannot enter the market with any new partners during the excludesive time period.

- Geography – there may be markets which you cannot effectively service in the near term. If this is the case, the impact of establishing a limited excludesive relationship in such secondary markets is less onerous.

- Market segments – like certain geographies, there may be groups of customers that are outside your primary target markets. If so, offering excludesivity with respect to such customers may have little impact on your business. However, beware, as this approach can be difficult to police, depending on the manner in which you are reaching these “excluded” market segments. If you anticipate that it may be difficult to effectively segregate the excluded market segments, attempt to denude the excludesivity via an alternative approach.

- Product lines / features – if you carry a line of products, consider limiting excludesivity to a particular product or even a product feature. I negotiated an agreement with a BDC that included exclusivity with respect to an insignificant feature in order to satisfy the BDC’s desire to “have some level of exclusivity.” We were precluded from offering this particular feature to other partners as long as the BDC met its minimum sales commitments. This approach also gave my Bro Foe an excludesivity alibi as he was able to tell his BDC Boss, “We got excludesivity,” without sharing the details.

- Distribution channels – in certain instances, you may be comfortable excluding your adVenture from secondary distribution channels. For instance, your primary distribution channel may be online sales, which you want to have the freedom to manage with no exclusions. However, retail distribution might be an area you are comfortable establishing an excludesive distribution agreement, given that target sales are reached.

Such limitations are helpful in making excludesivity more palatable. However, to ensure their effectiveness, define these limiting parameters in a manner consistent with the BDC’s ability to impact your business.

For instance, a digital imaging company in which I am an investor signed an excludesive deal with a BDC in which they carved out the endoscopic market. On the surface, this seems like a reasonable limitation. Unfortunately, the BDC has no presence in a number of endoscopic markets, including flexible endoscope procedures and laproscopic procedures. The startup is now effectively barred from establishing partnerships within these two very large markets, unless they renegotiate their deal with the BDC. Given that the BDC is holding all the negotiating cards, the startup will probably have to pay a significant price to free itself from these detrimental exclusions.

The Short List

Another way to limit the scope of your exclusions is to list a small number of companies with which you cannot enter into a similar deal. At first blush, the BDC will likely tell you that they compete “with everyone” However, every BDC has one or two nemeses which they consider to be their true competitors in a particular market or product line. Just because two companies compete at a macro level, such as Oracle and Siebel or Yahoo and Google, does not mean they are true competitors in every sub-market in which they are engaged.

Force the BDC to create a short list of these named competitors and include it as an exhibit to your partnership agreement. The list should be no more than two or three names, not a phone book of potential and fantastical competitors.

MFN Alert

As more fully discussed in Kiss of Death, Most Favored Nations (MFN) provisions are a disguised form of excludesivity. By precluding your firm from entering into subsequent agreements with “more favorable” terms than those entered into with a MFN BDC, you are significantly limiting your future negotiating flexibility. Fortunately, Kiss of Death includes a few simple tricks you can deploy in those rare instances when you are unable to keep this pernicious provision out of a partnership agreement.

Exclude the Handcuffs

It is simply not rational for an entrepreneur to limit his or her ability to follow the most lucrative path to success, especially at the outset of the adVenture. Startup years are like dog years; seven years at a BDC is equivalent to one year at a startup. This lively pace makes relationship prognostication nearly impossible. Deals that appear vital today often morph into inconsequential former relationships overnight. In contrast, relationships which seemed tangential at the outset can become company-changing partnerships as markets and competitive landscapes shift over time. By placing handcuffs on your startup, in the form of excludesive relationships, you are reducing the probability that you will maximize your adVenture’s value creation and thus potentially limiting the ultimate size of your adVenture’s Exit.

It is simply not rational for an entrepreneur to limit his or her ability to follow the most lucrative path to success, especially at the outset of the adVenture. Startup years are like dog years; seven years at a BDC is equivalent to one year at a startup. This lively pace makes relationship prognostication nearly impossible. Deals that appear vital today often morph into inconsequential former relationships overnight. In contrast, relationships which seemed tangential at the outset can become company-changing partnerships as markets and competitive landscapes shift over time. By placing handcuffs on your startup, in the form of excludesive relationships, you are reducing the probability that you will maximize your adVenture’s value creation and thus potentially limiting the ultimate size of your adVenture’s Exit.

—

Copyright © 2008 by J. Meredith Publishing. All rights reserved.

Pingback: Recent Links Tagged With "bdc" - JabberTags

Pingback: Driving The Mouse | infoChachkie

Pingback: Ten Rookie Startup Mistakes You Won’t Make

Pingback: Ten Rookie Startup Mistakes You Won’t Make