A version of this article previously appeared on Forbes.

A version of this article previously appeared on Forbes.

Venture Capital is a game of pattern matching. Whenever a VC assesses a potential investment opportunity, they attempt to match the entrepreneur(s), their solution, and intended markets with a pattern they have previously encountered.

If you haven't already subscribed yet,

subscribe now for free weekly Infochachkie articles!

Hairy Pattern Matching

Such pattern matching is a defense mechanism. Given the thousands of startups Venture Capitalists review annually, they must adopt efficient methods of quickly assessing if a person/opportunity is worth further diligence. Even though the initial pattern-matching filter they apply may be somewhat capricious, it is a pragmatic way to deal with an otherwise overwhelming data avalanche.

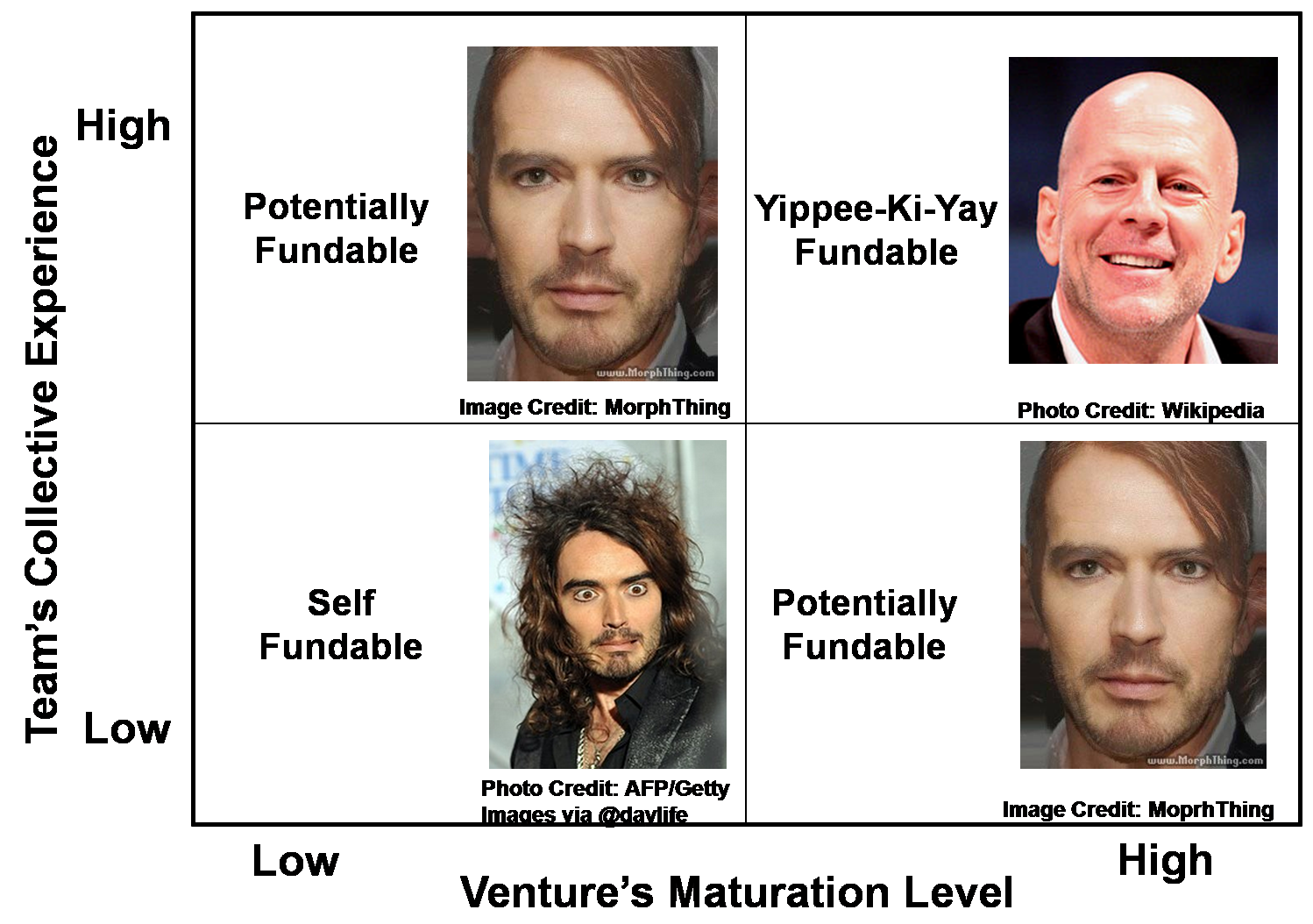

Pattern matching involves identifying deal hair; significant flaws which increase the deal's risk of failure (see 8 Deal Breakers & How To Avoid Them). Two of the most common types of deal hair involve: (i) the experience and maturity level of the core team, and (ii) the venture’s stage of maturation. These factors must be assessed together because in some cases they amplify each other and in other instances they are counteractive.

For instance, if a startup team is relatively inexperienced, but their venture is on a reasonable path to sustainability, then the operational risk associated with the team’s limited experience is significantly mitigated. Conversely, even if a venture is pre-revenue, the operational risk is reduced if the entrepreneurs have a relevant track record of success. Thus, these two variables should be evaluated in tandem, as depicted below.

As shown above, a Bruce Willis deal is one with virtually no hair. It represents a deal in which the management team has deep domain expertise and the venture’s value proposition has been market validated. Bruce Willis deals command hefty valuations, as new injections of capital are typically applied to growing a self-sustaining business, rather than funding an ongoing burn rate.

At the other extreme, Russell Brand deals are covered with hair because the entrepreneurs lack relevant experience and their market opportunity is unproven. Russell Brand deals are often so inundated with hair that it is impossible to see the opportunity that may lie beneath.

Such deals are ideally funded by customer dollars until the opportunity is adequately proven and/or management accrues an adequate level of experience. In practice, Russell Brand deals are typically funded by the Three F's (friends, family and fools).

Despite the Bruce Willis and Russell Brand extremes, most startups that qualify for serious evaluation by institutional investors fall into the Potentially Fundable category. These deals comprise both promising and troubling attributes. No matter how attractive the opportunity, there are always risk factors that detract from a deal’s desirability.

Know Thy Pattern

The above criteria obviously do not represent all of the factors investors consider when evaluating a venture investment. Other patterns VCs look for include:

- Technical Guru with great ideas, but no management experience

- Sales Guy who can package and promote the opportunity, but who has minimal product development capabilities

- Visionary Founder who identifies strategic market opportunities but cannot appropriately accept input from others

- Corporate Refugee without entrepreneurial experience, but has proven his leadership capabilities at a big company

Each of these patterns entails positive and negative characteristics that both excite and alarm venture capitalists. In the instance of the Tech Guy, the VC might be concerned that he will focus too much on developing cool product features and potentially ignore non-product issues. With the Sales Guy, the venture capitalist might extrapolate that he will over-promise the company's capabilities and ultimately deliver a sub-standard product to market.

Entrepreneurs must be self aware in order to properly manage this pattern-matching phenomenon. The key to self-awareness is the ability to see yourself through the eyes of others. Unfortunately, this is often especially difficult for young entrepreneurs, as they lack adequate experiences upon which they can honestly assess their strengths and weaknesses.

By anticipating such pattern matching, you can proactively address concerns that your particular pattern might raise. Thus, the tech guy would be well served to emphasize his willingness to delegate business issues to more experienced team members, whereas the sales guy should be careful to not overly promote himself or the opportunity and to acknowledge his technological shortcomings.

Entrepreneurs should also proactively address the pattern-matching proclivity of particular investors. In advance of speaking with a venture capitalist, research the deals they are personally involved, as well as the deals championed by other Partners in their Firm. From this list, identify one or more portfolio Founders that most closely fit your pattern. This exercise will help you guide the VCs to assign a label to you in which they have previously invested.

Recognition Is The First Step

Simply knowing that venture capitalists will attempt to lump you into a preconceived pattern is helpful. Before you seek investment capital, do what you can to remove the hair from your venture. Any hair you cannot remove should be shampooed, conditioned and styled in the most attractive manner possible. Trying to cover up deal hair with a beanie and deny its existence is not a viable strategy.

Your goal is for the venture capitalist to assess your pattern and say, “I have seen this movie before and I want to see it again, because the ending is great. Yippee-Ki-Yay Mother Bleeper!”

Follow my startup-oriented Twitter feed here: @johngreathouse. I promise I will never tweet about Die Hard XX or that killer burrito I just ate.